Liquidation Lawyers

Liquidation by Creditor

In New Zealand, debtors can struggle to pay all debts in full. This can occur for a variety of reasons.

We have specialist liquidation lawyers who assist our clients to navigate the non-payment of its debtors. We apply robust debt collection strategies. We help to strategically determine the correct procedure or whether an alternative will result in the best outcome for all concerned.

In some cases, an application to liquidate debtors is necessary.

At Norling Law we offer a FREE 30-minute Legal Consultation where we can discuss the issues and we can add strategic value. After the discussion, we can decide whether we can help you and at what cost.

The Liquidation Process

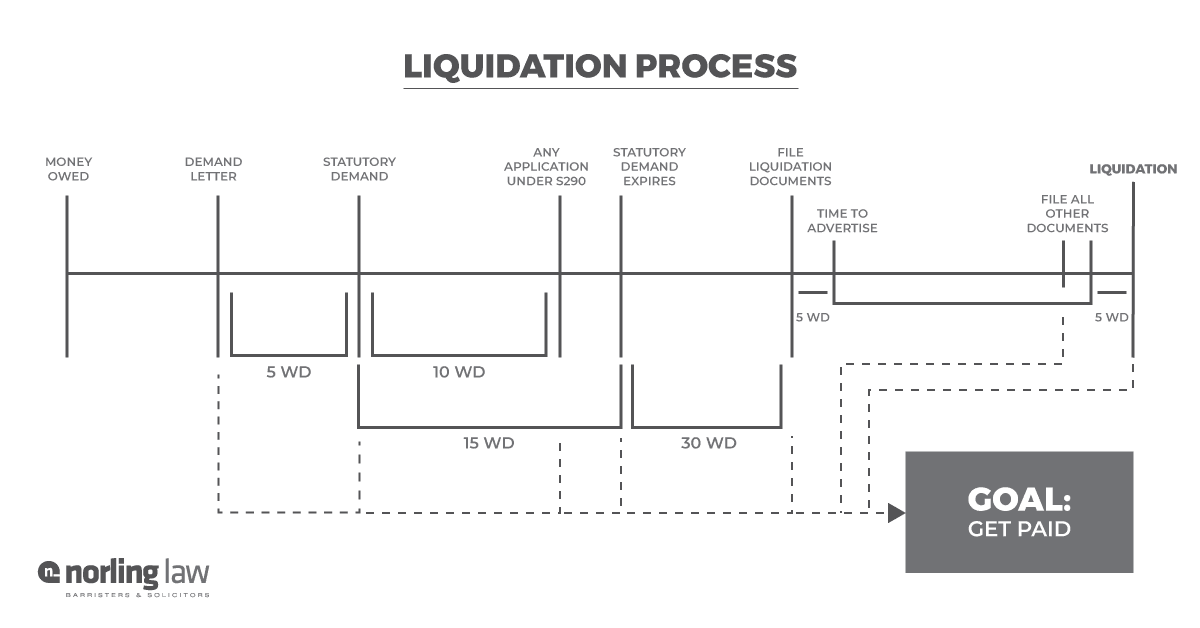

Below we set out the process that creditors follow in order to liquidate a company. While the goal is to get paid by the debtor company, this process is often used to increase the chances of payment.

How does a Creditor Liquidate a Debtor Company?

A liquidation is the means by which a company’s assets are collected and distributed to its creditors in a set scheme of priorities.

A creditor may liquidate a Company by application to the High Court.

Does a creditor have to issue a Statutory Demand in order to liquidate?

Most commonly, creditors appoint a liquidator by utilising the statutory demand process (if the debt is more than $1000) and then if unsatisfied, file an application at the High Court seeking a liquidation order.

However, a statutory demand is not always necessary. We have liquidated companies on many occasions without utilising this method.

Due Diligence on the Debt

Obtaining instructions and assessing the file is a crucial part of the process. Get it wrong and the consequences can be disastrous for the client and the lawyer.

At the outset, the solicitor ought to assess the ‘debt’. It is advisable that the solicitor confirms:

- The debt is due;

- There is no substantial dispute as to whether the debt is due or owing;

- The debt is owed by a company registered in accordance with the Companies Act 1993; and

- The company is not struck off, in the process of being struck off, or already placed into liquidation, by checking with the Companies Office.

The last two points may seem obvious. However, it is worth ticking those boxes, especially in the wake of the companies being regularly struck off by the Ministry of Business, Innovation and Employment for non-compliance with the Act.

Before a statutory demand is served, it is the obligation of the solicitor to ensure that the debt is due and owing and there is no substantial dispute as to whether it is due and owing.

It is also worth considering less formal options. A letter from a solicitor, on letterhead, is often all that is required to ensure that a bad debtor pays. It is, therefore, a good practice for the solicitor to initially write to the debtor and demand payment. This approach has a secondary advantage of shaking out potentially unidentified defences. On that basis, this is an important informal part of the process.

If a statutory demand is issued and a potential defence is pleaded in an application to set aside the statutory demand, defending the application can be costly to the issuer of the statutory demand.

After a statutory demand is served on a debtor company, the debtor company has 15 working days to either pay the debt, enter into a compromise or compound with the creditor, or give a charge over the property, to the reasonable satisfaction of the creditor.

An application for liquidation of the debtor company cannot be made until the expiry of 15 working days.

However, pursuant to s 290 of the Companies Act 1993, the debtor company may also apply to set aside the statutory demand within 10 working days of service if:

- There is a substantial dispute whether or not the debt is owing or is due; or

- The company appears to have a counterclaim, set-off, or cross-demand and the amount specified in the demand less the amount of the counterclaim, set-off, or cross-demand is less than the prescribed amount; or

- The demand ought to be set aside on other grounds.

If an application is made, for it to be valid it must be filed and served within 10 working days or it will not be heard by the High Court.

If the debtor company does not comply with the statutory demand within 15 working days of service, it gives rise to a rebuttable presumption that the debtor company is unable to pay its due debts. This presumption lasts for a finite period.

The liquidation process is fairly straightforward, but it is riddled with mandatory timeframes where the Court does not retain discretion. These timeframes must be adhered to in order to avoid onerous consequences.

Here is a more Detailed Breakdown of the Statutory Demand Basics.

Shareholder Appointment of a Liquidator

The shareholders are unable to appoint a liquidator of their choice once the company has been served with an application to liquidate the company by a creditor.

Any appointment after the serving of liquidation proceedings is invalid, unless the creditor who made the application to Court consents to this, and the Court will appoint a liquidator in their place. Subsequently, time is of the essence in these situations.

Creditor Committee

It may become useful for a liquidation committee to be appointed at the creditors meeting. A liquidation committee has a supervisory role over the liquidators.

The Liquidation

The Liquidators primary duty is to take possession of and sell assets for the benefit of creditors.

A liquidator will:

- Call a creditors’ meeting (in some cases);

- Investigate the affairs of the company;

- Investigate the governance of the directors;

- Take possession of the company’s asset;

- Realise assets;

- Distribute funds;

- Report any criminal activity.

Can Shareholder/Directors be sued?

In reality, most Liquidators are not overly litigious. However, some are very litigious.

Liquidators have many causes of action to sue Director/Shareholders. Some of these are:

- Overdrawn Current Accounts;

- Transactions at undervalue;

- Breaches of Director Duties;

- Failing to prepare financial records;

- Voidable Transactions.

Who Should be Appointed as Liquidator?

Creditors ought to be encouraged to investigate the individual liquidator and their history in similar situations.

Liquidators are not equal.

Fortunately, judicial decisions are publicly searchable, so it takes an insignificant amount of research to determine the liquidator’s reputation.

It is crucial to appoint a liquidator who will pursue the interests of creditors vigorously.

More Information

Here is a more detailed analysis of the Process and Pitfalls of Creditors Appointing a Liquidator.

We assist clients to navigate this process correctly. There are many pitfalls if implemented incorrectly.

Please refer to our People for more information on who we are, our experience and how we can help you.

If our expertise can be of assistance, do not hesitate to Contact us for a conversation or Schedule a FREE 30 minute Legal Consultation withBrent.

We have offices on the North Shore in Auckland, New Zealand or can have the consultation by phone.